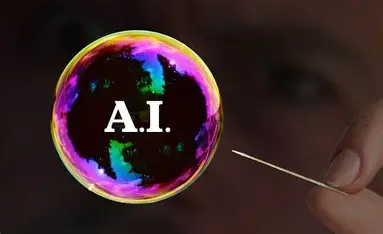

The unstoppable rise of Artificial Intelligence (AI) in financial markets could be facing its first major reckoning.

Once hailed as the next big thing, AI’s grip is now being questioned, with critics likening its meteoric rise to the 1990s Dot Com bubble.

A damning MIT report reveals 95 per cent of firms are seeing no returns on Ai investments, while NVIDIA stock recently suffered a 3.5 per cent intra-day drop.

The result? A growing divide among investors, split between fears of an AI bubble and confidence in its staying power.

Speaking with Andrew Elphick, former Barclay’s Head of Fintech Strategy and Open Innovation, the expert brushed aside concerns of an AI bubble.

“You’re going to have an adoption curve,” he said, comparing the AI boom to other major technology trends.

He argued the current AI hype is “different” from the Dot Com bubble of the 1990s.

“Now you have a greater capacity to test whether something actually works so you can make something enterprise ready,” he added, pointing to how vapourware plagued the 90s tech scene.

When asked whether the bubble will burst, Elphick was unconvinced.

He said: “I’m not convinced it will burst. They haven’t hit the ceiling with what is possible with AI.”

However, he warned against blind trust in AI, stating: “If we’re not thinking about kicking the tyres on what Gen AI produces, then we’ll end up causing ourselves a lot of issues.”

Comments